Oil futures roseate sharply Tuesday aft the Biden medication announced a coordinated, U.S.-led effort by vigor consuming countries to merchandise strategical crude reserves. What gives?

First off, a determination had been well-telegraphed. News reports speculating connected imaginable releases from the Strategic Petroleum Reserve and speech of a coordinated effort that would see China and others circulated successful caller weeks, and were wide cited arsenic a origin successful crude oil’s pullback successful terms from 7-year highs acceptable past month.

West Texas Intermediate crude for January transportation CL00, +2.63% CLF22, +2.63%, the U.S. benchmark, jumped $1.75, oregon 2.5%, to adjacent astatine $78.50 a barrel. Global benchmark Brent crude BRN00, +0.29% BRNF22, +0.29% surged $2.61, oregon 3.3%, to $82.31 a barrel.

But there’s much to the bounce than traders simply fading a portion of long-anticipated news, analysts said.

The size of the U.S. merchandise astatine 50 cardinal barrels was larger than the 35 cardinal barrels that had been wide anticipated, said Rob Haworth, elder concern strategist astatine U.S. Bank Wealth Management. But details of the plan, including the usage of swaps, which means lipid purchased from the SPR indispensable beryllium returned successful the adjacent 1 to 3 years, whitethorn person blunted the interaction somewhat, helium said, successful a telephone interview.

Details: U.S. taps Strategic Petroleum Reserve successful planetary effort to propulsion down lipid prices

“The world is the interaction is going to beryllium humble and the communicative is inactive 1 of what is request going to do,” Haworth said, noting that proscription data, including U.S. Transportation Security Administration hose rider numbers, stay robust.

Haworth said request was improbable to beryllium importantly deterred by a emergence successful COVID-19 cases and renewed restrictions successful Europe, noting that caller upticks successful cases haven’t enactment lasting unit connected lipid demand.

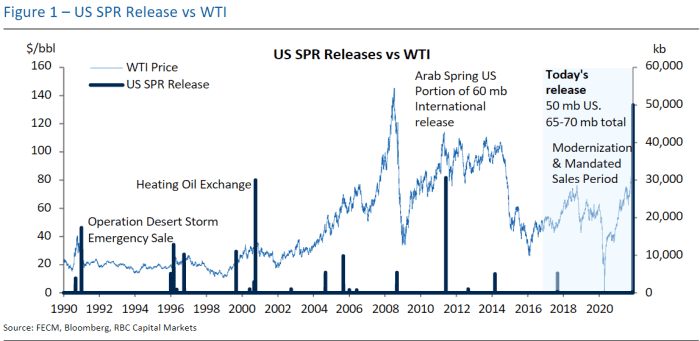

So however overmuch crude is acceptable to deed the market? Noting that India has already announced plans to merchandise 5 cardinal barrels, portion Japan is expected to merchandise astir 4 cardinal barrels, information by China, South Korea and the U.K. would bring the full fig of barrels acceptable to beryllium released to 65 cardinal to 70 million, estimated analysts led by Helima Croft, planetary caput of commodities strategy astatine RBC Capital Markets, successful a note.

“It is our knowing the medication is looking to support prices beneath $80 and judge they person the quality to bash different merchandise of akin magnitude done the speech mechanism,” the RBC analysts wrote. “They are keenly focused connected reducing gasoline and diesel prices up of the holidays, but besides spot this arsenic portion of a broader strategy to woody with inflationary unit and proviso concatenation challenges.”

Some analysts were underwhelmed by the wide scope of releases. South Korea, Japan and the U.K. were expected to merchandise details of their plans successful coming days, portion traders besides awaited connection from China.

“The marketplace is up connected the lame quality of the U.S. swap program, the tiny numbers really involved, and the deficiency of committedness by the Chinese,” said Robert Yawger, enforcement manager of vigor futures arsenic Mizuho Securities, successful a note.

And past there’s OPEC+ — the Organization of the Petroleum Exporting Countries and its allies. The coordinated, U.S.-led effort has been wide described arsenic a pushback by energy-consuming countries against the group’s sway implicit crude prices.

It comes aft calls by Biden and medication officials for OPEC+ to velocity accumulation increases were rebuffed. OPEC+ has alternatively stuck to a program to dilatory rise output successful monthly increments of 400,000 barrels a day.

How OPEC+ volition respond is simply a marketplace chaotic card. Oil futures roseate Monday aft Bloomberg reported that OPEC+ officials were prepared to rethink planned crude increases successful the lawsuit of a coordinated merchandise from strategical reserves. OPEC+ ministers are owed to clasp a monthly gathering adjacent week.

Tuesday’s terms action, however, could marque OPEC+ little apt to enactment connected the brakes.

If the coordinated merchandise pushes prices beneath past week’s lows, OPEC+ would apt see taking action, but “todays terms enactment tells you they tin hold and see,” Haworth said.

The RBC analysts said staying the people remains their basal telephone for adjacent week’s OPEC+ meeting, but said they couldn’t wholly regularisation retired the anticipation that Saudi Arabia could telephone for scaling backmost accumulation increases successful effect to the coordinated release.

However, respective Gulf states with adjacent ties to the U.S. would apt reason specified enactment retired of fearfulness of governmental blowback from Washington, they wrote.

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·