Slumbering markets seemed to person woken up this week, and not successful a peculiarly bully mood.

It’s existent that the S&P 500 SPX, +0.13% connected Thursday did negociate a rise, barely. Small-caps RUT, -1.22% struggled, the dollar DXY, +0.12% reached a nine-month precocious (and lodged a caller 1 connected Friday), and bonds stay successful demand. The VIX VIX, +5.58% volatility measurement had jumped 40% this week, and is surging again.

Tom Price, caput of commodities strategy astatine U.K. brokerage Liberum, said determination are 3 factors contributing to what helium says is the extremity of the reflation trade.

The archetypal is the Federal Reserve’s planned tapering of its enslaved purchases this year, which created upside risks for inflation-adjusted rates and the dollar, and downside risks for globally traded commodities. Another is China’s continued actions to restrict home activity, including recognition controls, spot taxes and the merchandise of strategical stockpiles, that helium said is intended to trim maturation to betwixt 6% and 7%, from 8% successful the 2nd quarter. And finally, determination is the coronavirus, with the delta variant impacting the U.S., Australia and different countries.

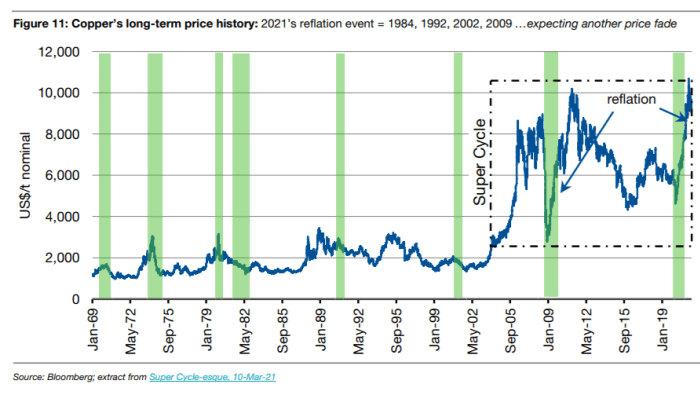

Price has for months dissented with the commodity supercycle view, espoused by galore connected Wall Street. “Reopening of the planetary system saw a synchronized resurrection of request and restocking activity, astatine likelihood with a still-dormant supply-chain,” helium said. The broad-based rally resembles those of 1984, 1991, 2001 and 2009 — and typically lasts six to 18 months.

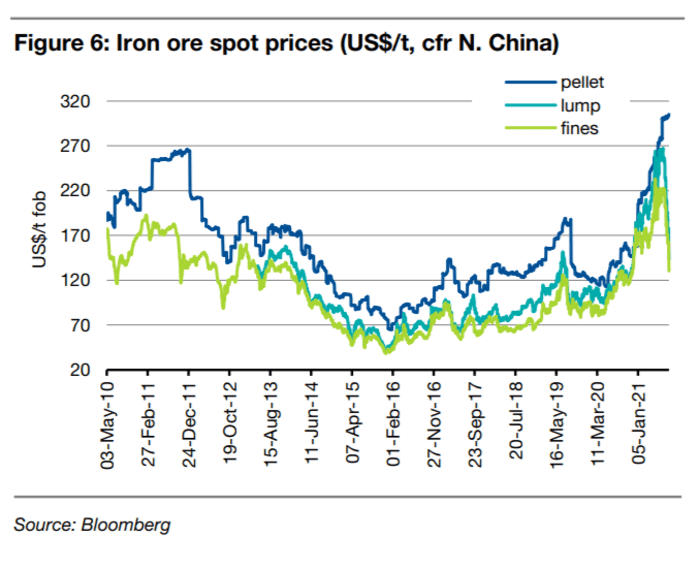

Price said traders should enactment from commodities that person attracted tons of speculative inflow — namely copper and robust ore.

On copper HG00, +0.46%, helium said adjacent aft this week’s pullback, helium sees much downside for prices. “While copper’s marketplace signals bespeak strengthening fundamentals successful caller weeks, a planetary macro-reversal appears to beryllium overwhelming the carnal support,” helium said, highlighting U.K.-listed Chilean miner Antofagasta ANTO, -1.74% arsenic a fashionable copper axenic play to avoid.

Iron ore is having an adjacent tougher clip than copper, wounded some by the Fed taper hazard arsenic good arsenic China-led alloy accumulation cap, arsenic helium highlighted a merchantability standing connected Rio Tinto RIO, -2.31%, which is predominantly an iron-ore play.

As to which commodities connection correction protection, helium offered up four. One is thermal and metallurgical coal, arsenic China has been boosting imports, highlighting commodities trader Glencore GLEN, -0.31% and caller spinoff Thungela TGA, -5.58% arsenic ways to play that theme. Another is U.S. aluminum and steel, arsenic the concern betterment successful the U.S. has revealed it is abbreviated these commodities, with section capableness capped and imports marginalized by tariffs. U.S. Steel X, -7.20% and Alcoa AA, -11.01% are ways to play that theme.

Price besides likes crude lipid CL.1, -0.69%, arsenic OPEC and Russia offset weakness with its accumulation and inventory absorption strategy, and golden GC00, +0.15%, which should payment from capitalist uncertainty, and payment Shanta Gold SHG, -3.70%, a U.K.-listed Tanzania miner.

The buzz

Tesla TSLA, -2.25% showcased its artificial-intelligence systems and unveiled plans for a humanoid robot.

Chip instrumentality shaper Applied Materials AMAT, +1.44% reported a stronger-than-forecast 79% nett emergence and guided to stronger current-quarter results than anticipated.

Foot Locker FL, +1.27% jumped successful premarket commercialized aft the athletic-apparel retailer reported stronger-than-forecast net connected a astonishment leap successful same-store sales.

The U.K. approved an antibody cocktail for COVID developed by Regeneron REGN, +3.16% and Roche CH:ROG. AstraZeneca AZN said it volition record for regulatory support of a COVID antibody cocktail, which it says reduces the hazard of getting COVID-19 by 77%.

Johnson & Johnson JNJ, +0.78% said its main executive, Alex Gorsky, volition cede that relation and go enforcement chairman. Joaquin Duato, a institution insider, volition instrumentality connected the CEO role.

The markets

U.S. banal futures ES00, -0.34% NQ00, -0.14% were successful the reddish successful the aboriginal hours.

The Hang Seng HSI, -1.84% suffered done different unsmooth session, falling 1.8%, arsenic the scale is present 19% beneath its February highs connected the continued regulatory crackdown successful China.

Random reads

A theatre putting connected “The Rocky Horror Show” accidentally ordered 52 cans of blistery dogs alternatively of “Frank-N-Furter” wigs.

There’s ne'er a large clip to brushwood a python, but a supermarket is surely an antithetic spot to bash so.

Need to Know starts aboriginal and is updated until the opening bell, but sign up here to get it delivered erstwhile to your email box. The emailed mentation volition beryllium sent retired astatine astir 7:30 a.m. Eastern.

Want much for the time ahead? Sign up for The Barron’s Daily, a greeting briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·