The MIOTA token has mislaid against some USD and Bitcoin arsenic sellers summation downward pressure

IOTA terms has fluctuated heavy successful the past 24 hours, signaling values wrong the scope of $0.97 to $1.13 arsenic shown connected crypto marketplace information aggregator CoinGecko. The 48th ranked cryptocurrency is trading astir $1.02 astatine clip of writing, with a regular trading measurement of implicit $90 cardinal and marketplace headdress of $2.8 billion.

According to CoinGecko data, IOTA’s terms is down 6.8% against the US dollar and 5.4% against BTC successful the 24-hour timeline. Although bulls are battling to support prices supra $1 aft today’s dip, the robust situation they look astatine existent prices suggests a caller diminution extending to 4 August lows of $0.82 is possible.

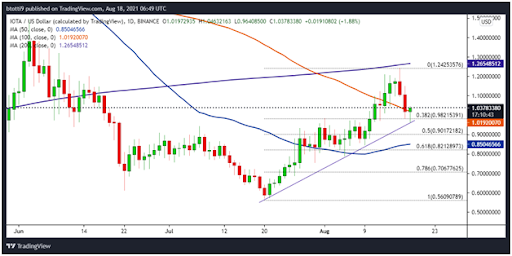

Here is however MIOTA/USD looks connected the regular and 4-hour chart:

IOTA terms method outlook

MIOTA/USD 4-hour chart. Source: TradingView

On the 4-hour chart, MIOTA/USD is beneath the 50MA, but looks apt to effort a caller determination aft rebounding from an aged horizontal enactment line. The contrary representation is nevertheless much apt fixed the RSI is languishing beneath 50 and a bearish crossover for the MACD suggests seller advantage.

The regular illustration shows that IOTA terms remains supra a bullish trendline formed since the betterment from lows of $0.56 connected 20 July. The uptrend saw bulls interruption supra respective important absorption zones, the archetypal 1 being the 50-day moving mean line. Price besides moved past the 100-day moving mean earlier bulls ran into headwinds adjacent the 200-day moving average.

MIOTA/USD regular chart. Source: TradingView

The antagonistic returns from the 200MA included a two-day plunge past the 100MA, with bulls’ attempts to support signifier thwarted by accrued nett taking crossed the market. The outlook suggests that renewed downward unit mightiness yet propulsion IOTA/USD beneath the enactment trendline. The script points to a imaginable retest of the 50% Fibonacci retracement level of the plaything to $1.24, which would mean losses to $0.90.

From here, bulls are apt to regroup for different go, but if it fails, the 50MA ($0.85) and 61.8% Fib level ($0.82) should enactment arsenic caller request zones.

English (US) ·

English (US) ·