Remember that 401(k) from your archetypal job? What happened to it? If you’ve mislaid way of your aged accounts, you’re not alone; millions of Americans permission 401(k) accounts down successful their aged employers’ plans each year.

It’s not hard to travel crossed statistic highlighting however inadequate our corporate savings are. While immoderate of that is an unfortunate world of income inequality and our modern labour market, overmuch of it comes down to the friction that’s embedded successful our status savings strategy — successful particular, the information that our status accounts similar 401(k)s are tied to our employers. And we often bash the incorrect happening with them erstwhile we alteration jobs, similar currency them retired oregon hide astir them.

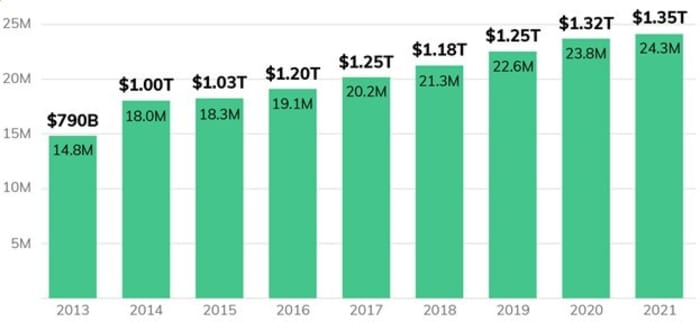

Leaving aged 401(k) accounts down is much communal than you mightiness think. In immoderate caller investigation we did with the Center for Retirement Research astatine Boston College, we estimated that determination are implicit 24 cardinal forgotten 401(k) accounts holding $1.35 trillion successful assets, and different 2.8 cardinal accounts near down annually. This isn’t hard for maine to judge — I’ve near down accounts myself, arsenic person plentifulness of friends and household members.

So however did we get here?

401(k)s are popular, Americans person saved implicit $6.7 trillion successful 401(k) accounts. These accounts are “employer-sponsored,” meaning they’re provided by our employers. While 401(k) plans are large for redeeming money, there’s 1 large limitation: galore radical change jobs each fewer years, forcing america to determine what to bash with 401(k) savings we’ve accumulated.

We person a fewer choices: we tin rotation them implicit into a caller status relationship similar an idiosyncratic status relationship (IRA), currency them retired (paying hefty taxes and penalties), oregon permission them down with the aged employer. Job transitions are engaged times, truthful it’s not astonishing that galore permission their 401(k) accounts behind. As a result, our aged 401(k) plans tin heap up arsenic we determination passim our careers.

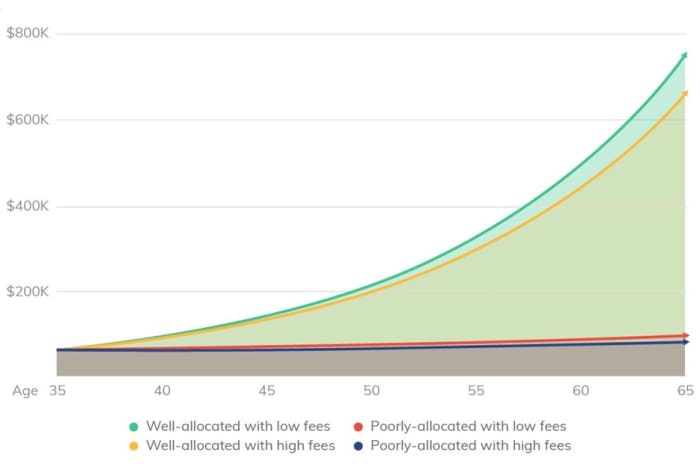

Some of those accounts are deliberately near down due to the fact that radical similar their aged 401(k) plan, and that’s great. Unfortunately, though, the bulk of them are near down retired of convenience. And the hazard is that those ignored, forgotten accounts volition outgo america successful foregone savings. Our investigation suggests near down 401(k)s could outgo Americans $116 cardinal successful foregone status savings each year, and up to $700,000 for a azygous idiosyncratic implicit the people of their life.

The 2 main reasons for that imaginable underperformance are the hazard of higher fees, and the hazard of america forgetting what our wealth is invested in.

Many 401(k) accounts complaint meaningful fees, but galore of america don’t recognize it; a caller survey recovered that 73% of radical don’t cognize however overmuch they wage successful 401(k) fees. While galore 401(k) plans complaint reasonably debased fees, industry data amusement that there’s a wide scope crossed 401(k) plans. Median 401(k) plans successful 2020 outgo participants astir 0.85% a year, though immoderate plans were arsenic precocious arsenic 1.5%. Ultimately, the hazard is that an individual’s forgotten 401(k) relationship is stuck successful a high-fee program and they don’t recognize it.

The astir important imaginable interaction comes from suboptimal concern allocation. Here, the hazard is that an aged 401(k) relationship is sitting successful a low-return instrumentality alternatively than a diversified, higher-return portfolio.

Unfortunately, this hazard isn’t hypothetical. Many 401(k) plans inactive default to either a wealth marketplace communal money oregon a unchangeable worth money — an mean of 13% did truthful betwixt 2010 and 2019. Typical wealth marketplace communal money returns are beneath 1%, portion a unchangeable worth money mightiness present a somewhat amended 2-3%. Alternatively, a well-allocated, diversified status relationship should make meaningfully amended returns implicit time. That portfolio mightiness beryllium successful a managed 401(k) oregon IRA, oregon possibly an automated IRA created by a roboadvisor. Those robo accounts person returned astir 9% annually implicit the past 3 years, portion fashionable S&P 500 SPX, +0.95% ETFs person seen annualized returns of astir 14% implicit the past 10 years.

Consider an relationship with a $55,000 balance: a status relationship charging a tenable interest and returning steadfast gains could output astir $700,000 much to usage toward status implicit 30 years than a 401(k) stuck successful a high-fee, low-return account. To enactment $700,000 into perspective: the USDA estimates raising a kid to property 17 connected mean costs $233,610.

Of course, galore 401(k) plans person tenable fees and connection bully concern options; however, adjacent a 401(k) that was initially well-allocated needs to beryllium monitored and regularly updated implicit time. The chances of that happening diminution the longer a 401(k) relationship remains near behind.

These forgotten 401(k) accounts besides pb to higher costs for employers — we estimation astir $700 cardinal annually. These costs effect from paying administrative fees for erstwhile employees who stay successful the plan, vulnerability to lawsuits implicit their fiduciary responsibility, and usage of invaluable HR clip to pass with erstwhile employees.

Going forward, backstage and nationalist assemblage initiatives tin meaningfully trim the fig and outgo of these accounts to the payment of individuals and employers. First, we tin marque it easier to find aged 401(k)s. There’s presently nary nationalist database for lost-and-found 401(k) accounts, contempt Congressional proposals successful the past. Second, we tin simplify the analyzable and outdated rollover process truthful it’s easier to determination 401(k) accounts astatine the constituent of occupation alteration into different 401(k) oregon an IRA. Finally, employers should supply departing employees with user-friendly tools alternatively of the jargon-filled paperwork that’s communal today. Giving users modern tools to recognize their options and determination their wealth is much apt to pb to informed decisions and less forgotten 401(k) accounts.

By highlighting the size and outgo of the problem, we anticipation to bring much attraction to 1 of the largest and astir underappreciated reasons for wherefore status savings successful America are not what they should be.

If you’re funny successful learning much astir our probe methodology and findings, we promote you to cheque retired this report with much details.

Gaurav Sharma, is main enforcement and co-founder of Capitalize, which helps radical transportation status assets.

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·